Facilitation of Exports from Maharashtra:

The major elements of Maharashtra Export Promotion Policy are as below:

- Creation and strengthening of export promoting infrastructure and facilities.

- Exclusive Incentives for the Exporters, Export Oriented Units (EOUs).

- Promotion of ODOP and GI products for stimulating the exports.

- Institutional arrangement for Export facilitation.

- Ease of Doing Export (EoDE) under the initiatives of EoDB.

- Convergence of policies of state government to promote Export.

- Maharashtra Export Promotion Council (MEPC) committee under the chairmanship

- of Honorable Minister (Industries).

- Features of Export Oriented Industrial Development Programme under Maharashtra State Export Promotion Policy:

The scheme offers the State support by way of Grant-in-Aid for creating and developing world class infrastructure to facilitate export ecosystem.

The components eligible are elaborated as below:

a) Basic infrastructure like Internal roads, Power, Water etc.

b) Supportive infrastructure like Common Effluent Treatment Plant (CETP), Cold Storage,

Ware-house facilities, Skilling and Incubation centers, Common recycling/ Resource

recovery facilities, High-speed telecommunication and Internet facilities, Digital

infrastructure, Plug-n-play facilities, Flatted factory complex, Safety and Disaster Risk

Reduction equipment, Trade support infrastructure, Export promotion facilities for

Farmer Producing Organization (FPO) such as Pre-processing, Storage (Cold chains),

Pack Houses etc.

c) Integrated Irradiation Infrastructure, High-end technology-based facilities to increase

shelf life of perishable agro-produce. Irradiation process involves controlled amount of

radiant energy to achieve in habitation of sprouting, delay in ripening, killing of incest

pest, parasites, pathogenic and spoilage microorganisms. This overall results in

extending the life shelf life of food and agro products keeping intact the basic

characteristics of the food and agro produce. This over all results in getting the

advantage of export.

d) Quality Standards to achieve Global competitiveness and Product Standards

development: Quality and Testing facilities to meet the standards of exporting

countries, R&D facilities.

e) Packaging and Designing facilities.

f) Green Initiatives like, Common Renewable Energy Generation (Solar, Wind, Bio),

Energy management equipment, Water harvesting, Reducing physical waste and

recycling of the wastage, Disposal and sustainable handling of biodegradable wastesin

industrial areas, Carbon management etc.

g) Connected Infrastructure like Transport and Logistics facilities, Container handling

facilities like Container Freight Station (CFS), Highway connectivity etc.

h) The project components to meet Last mile and First mile connectivity, Need based

infrastructure.

i) In addition to these the Empowered Committee (EC) may include sector specific

infrastructure gaps, need based facilities as per the need of the project.

Types of Export oriented industrial development programme

I. Export Oriented Specific Project (EOSP)

- Export Oriented Specific Project (EOSP):Under the export promotion policy, export oriented specific projects will be approved to address the specific gap related to export infrastructure/ facilities in the specific Industrial Pocket/ Cluster.

- The said projects will be supported with state grant as per zones described as below with a grant limit of Rs. 50 crores per project.

The Zone wise financial assistance from State under “Export Oriented Specific Project (EOSP)”:

| Zone | Taluka / Area Classification As per PSI -2019 | State Grant Contribution on Approved project cost | Remarks |

| I. | A & B | 40% | · For Export Oriented Specific Projects (EOSP) projects will be supported with Grant-In-Aid as per respected zones concerned to location of the project. Grant-in-aid is limited to INR 50 Crore. · Land must be with the Implementing Agency; Cost of Land will not beconsidered in the Project Cost. · The Cost of Building (CFC, Administrative building) shall not exceed 25% of the total project cost. The cost over and above 25% shall be borne by Implementing Agency. · Limited to 5 projects shall be permitted from each mentioned Zone. · Total of 15 Projects in a policy period will be approved under EOSP. · The projects applied under ASIDE Scheme of Govt. of India and compiling the norms of State’s export promotion policy will also be eligible under EOIDP |

| II. | C, D, D+ | 50% | |

| III. | Vidarbha, Marathwada, Ratnagiri, Sindhudurg & Dhule, Naxalism Affected Areas and Aspirational Districts as mentioned in PSI-2019 policy. | 60% |

ii. Export Oriented Industrial Park (EOIP) under export promotion policy:

The Export Oriented Industrial Parks (EOIP) will be a dedicated export promoting parks spread on minimum 100 acres of contiguous land for specific industries sector, related sector. The EOIP projects shall be with minimum project investment cost of Rs. 200 Crore. The EOIP projects will be also setup in the Port, Dry Port proximity area (as described in Maharashtra Port Policy) with minimum project investment cost of Rs. 100 Crore and minimum contiguous land of 50 acers. Out of total area minimum 20% area shall be earmarked for MSMEs with a name as “MSME Zone”. The EOIP shall be designed in such a way that proven exporting units shall be set-up on priority basis having export value of minimum 50% of total turnover. To confirm with the criteria, the last 3 years exporting performance will be observed

The integrated facilities that will be available for investors are as below:

- Common Infrastructure and Logistics Facilities:

- Technology and Communication Infrastructure:

- Transportation Infrastructure:

- Industrial Buildings and Warehouses:

- Port and Terminal Facilities:

- Business Support Centers:

- Amenities and Social Infrastructure:

- Commercial Area:

- Simplified Regulations:

Financial assistance under Export Oriented Industrial Park (EOIP):

| Zone | Taluka / Area Classification As per PSI – 2019 | State Grant Contribution on Approved project cost | Remarks |

| I. | A & B | 40% | · For Projects under EOIP will be setup in minimum 100 Acer contiguous land or on minimum 50 Acer in case of Port, Dry Port Areas. · The Integrated facilities includes the ‘State-ofthe-Art’ Basic industrial infrastructure, Supportive infrastructure, Export facilitating infrastructure, Social infrastructure and Common sharing facilities at single location. · Land must be with the Implementing Agency; Cost of Land will not be considered in the Project Cost. · The Cost of Building (CFC, Administrative building) shall not exceed 25% of the total project cost.The cost over and above 25% shall be borne by Implementing Agency. · Limited to 5 projects shall be permitted from each mentioned Zone. · The projects will be supported with Grant-InAid as per respected zones concerned to location of the project. Grant-in-aid is limited to INR 100 Crore. · Total of 15 Projects will be approved in a policy period under MS-EPP. |

| II. | C, D, D+, | 50% | |

| III. | Vidarbha, Marathwada, Ratnagiri, Sindhudurg & Dhule, Naxalism Affected Areas and Aspirational Districts |

Eligible Agencies under MS-EPP

i. Public Sector undertakings of State Governments.

ii. Other agencies of State Governments.

iii. Export Promotion Councils / Commodity Boards.

iv. Apex Trade bodies recognized under the EXIM policy of Government of India and

other apex bodies recognized for this purpose by the Empowered Committee.

v. The Private Industries / Industries Organizations/ Industries Associations

vi. Implementation agencies of the projects which were earlier placed for consideration

before the State Level Export Promotion Committee (SLEPC) established under the

ASIDE Scheme but could not be decided due to delinking of the scheme.

vii.Joint Venture of any of the above Government agencies where it has a major stake

holding are also eligible.

2 . Incentivizing the Export manufacturing units in the State:

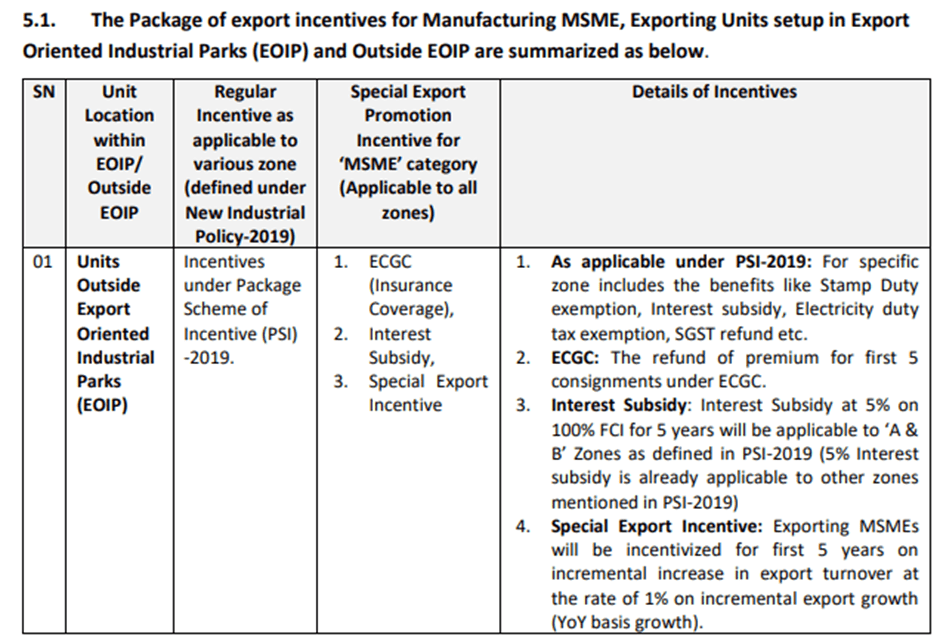

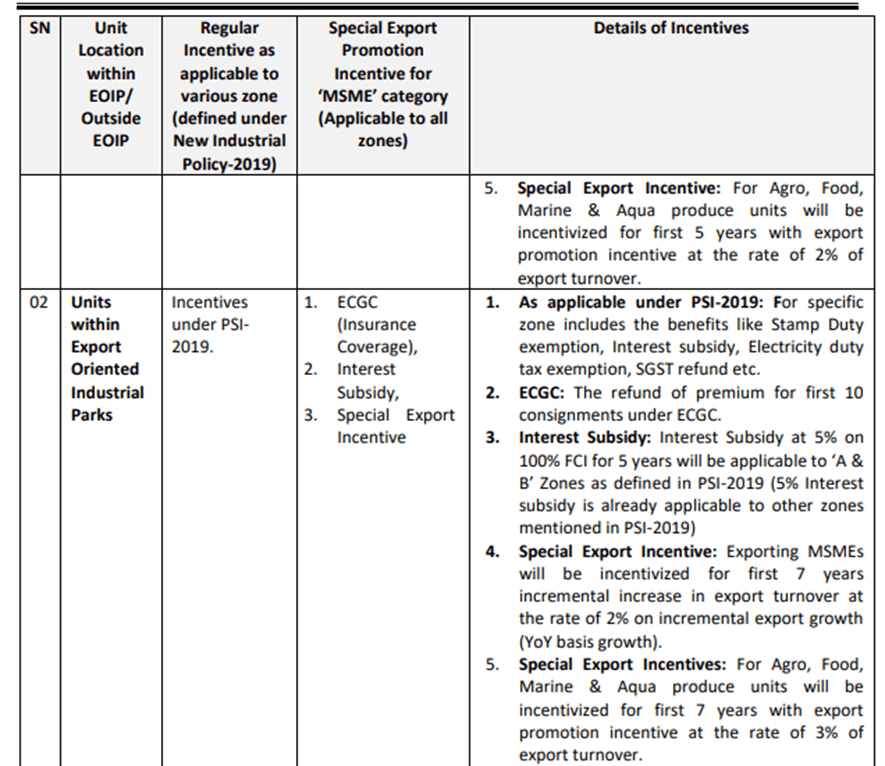

The State Government will incentivize the export initiatives of manufacturing units in the category of MSMEs and ‘Special Large category’. For availing the incentives under PSI-2019 policy, the MSMEs are defined as the fixed investment upto Rs. 50 Crore. The manufacturing units with fixed investment above Rs. 50 Crore (MSME Limit) and below the Large category limit.

export minimum 50% (30% for SC, ST and Women entrepreneurs) of their total turnover

The Interest Subsidy Incentive shall be applicable for 14 Production Linked Incentives (PLI) industry sectors as made eligible by Government of India under their PLI policy. The list of 14 eligible industry sectors is enumerated as below.

1. Large Scale Electronics Manufacturing

2. Key Starting Materials (KSMs)/ Drug Intermediaries (DIs) and Active Pharmaceuticals

Ingredients (APIs)

3. Manufacturing of Medical devices

4. Electronic/ Technology Products

5. Pharmaceuticals drugs

6. Telecom and Networking Products

7. Food Products including Aqua Food

8. White Goods (ACs & LED)

9. High Efficiency Solar PV Modules

10. Automobiles & Auto Components

11. Advance Chemistry Cell (ACC) Battery

12. Textile Products: MMF segment & technical textiles

13. Specialty Steel

Incentives for New MSME Entrants:

- Assistance to MSMEs for participation in International Exhibition:. The cost limited to INR 3.0 lakh or 50%

- The MSME exporter being the part of the delegation of EPCs, WTC, DGFT, FIEO will be assisted with the cost limited to INR 1.0 lakh or 50% for the general category and 75% for Women entrepreneurs/ Schedule Caste/ Schedule Tribe of the total cost of travel, whichever is less will be reimbursed limited to one time per unit per annum.

- Logistics incentives for 1st time MSME exporter: For first three years the logistics expenditure will be subsidies for 50% of the total logistics expenditure. The logistics expenditure will be reimbursement limited to INR 1 lakh per MSME per annum

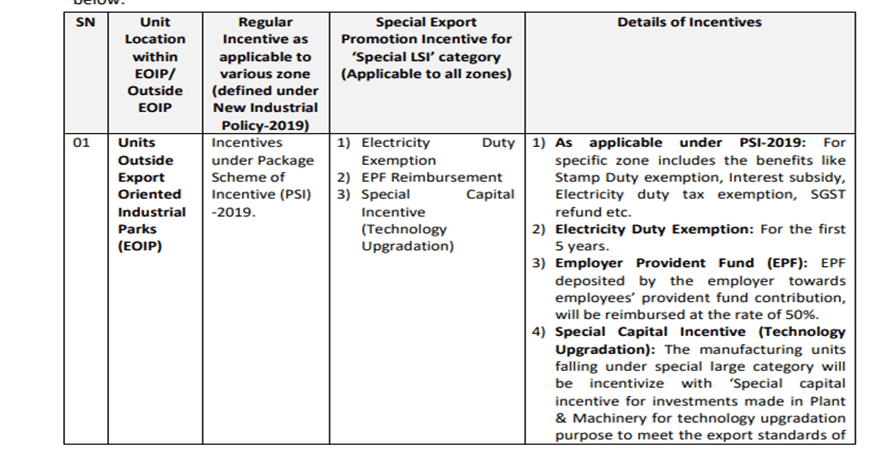

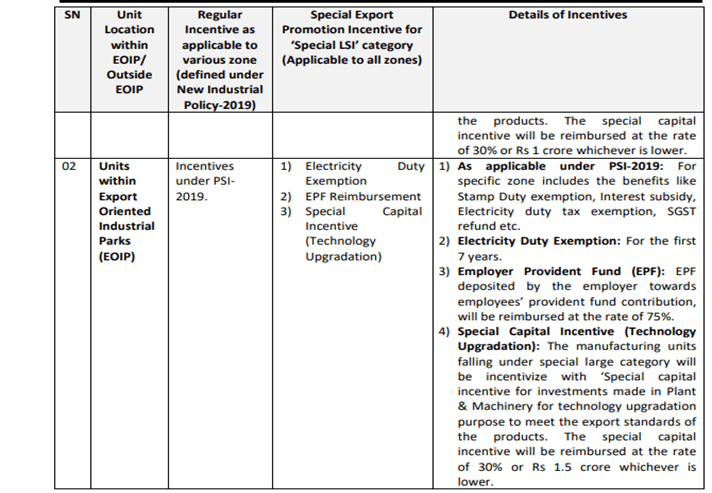

The Package of export incentives for Special Large-Scale Industries (LSI) (As defined in Para 5 above) : The manufacturing units in the ‘Special Large Scale’ Category exporting minimum 50% of their total turnover (30% of export turnover in case of Women, SC, ST entrepreneurs) shall be incentivized for their export performance by extending special package of incentives.

Add a Comment