Eligible Industrial

Undertaking or unit means any industrial undertaking (not being an industrial undertaking in the joint sector or public sector where the share capital of Government or a Government undertaking is 50% or higher) owned by any entity constituted as a company, partnership firm including a LLP, Society, Trust, Industrial Cooperative Society or Proprietary concern engaged or to be engaged in the manufacture, production, processing, contract manufacturing or job work of articles and set up as a new or expansion or diversification project set up in the State of Uttar Pradesh a) Here ‘Manufacturing’ means processing of raw material or inputs and assembling in any manner that results in emergence of a new product having a distinct name, character and use b) And ‘Job Work’ means any treatment or process undertaken by a person on goods belonging to another person 2.1.4. Expansion means, where an existing Industrial Undertaking increases its gross block by at least 25%. through new capital investment

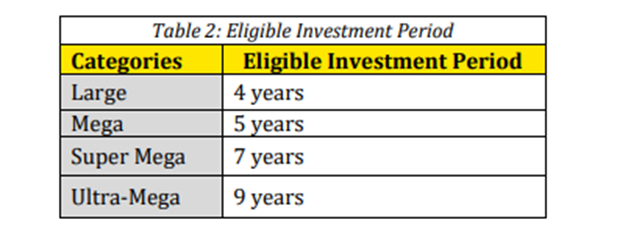

Eligible Investment

Period means the period commencing from the cut-off date falling in the Effective Period of this Policy up to 4 years or till the date of commencement of commercial production, whichever is earlier for Large projects; up to 5 years or till the date of commencement of commercial production, whichever is earlier for Mega projects; up to 7 years or till the date of commencement of commercial production, whichever is earlier for Super Mega projects; and up to 9 years or till the date of commencement of commercial production, whichever is earlier for Ultra Mega projects.

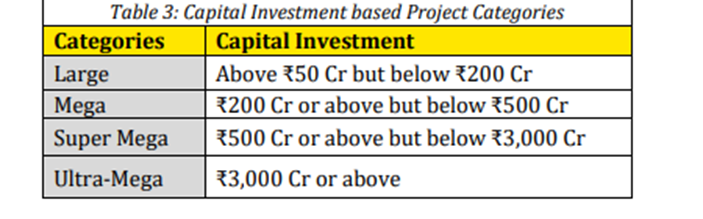

Capital Investment based Project Categories

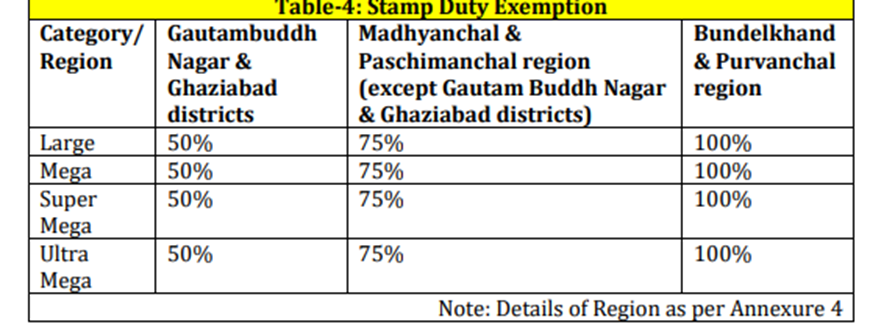

Admissible incentives

Stamp duty exemption

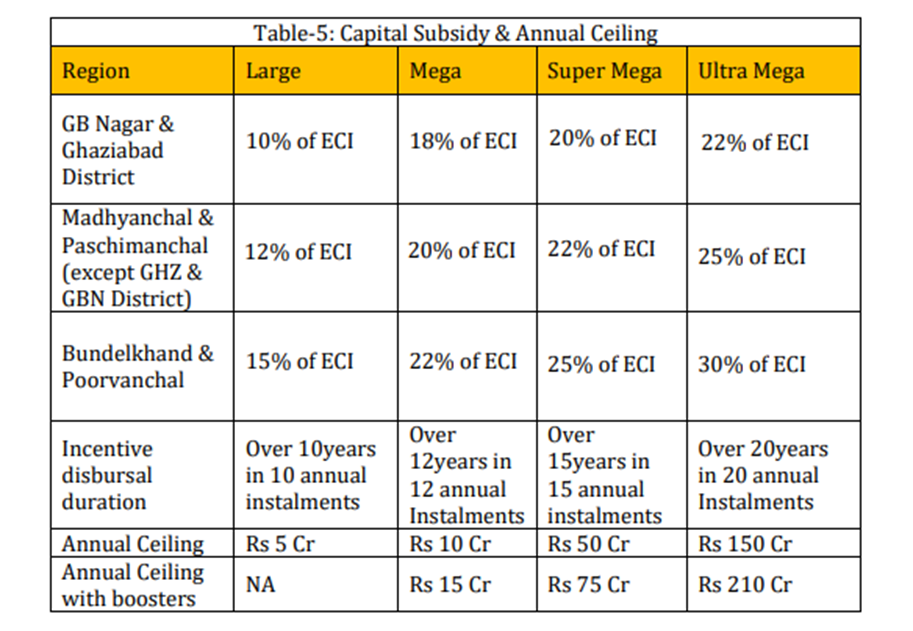

Investment Promotion Subsidy

as per Section 12.3 of the policy will be applicable to eligible industrial undertakings. 3.2.1. Option-1: Capital Subsidy 3.2.1.1. Under this option, eligible industrial undertakings can avail Capital Subsidy equal to the Base Capital Subsidy, as provided in the Table5, multiplied by a Gross Capacity Utilisation Multiple (GCM) in annual instalments and subject to an Annual Ceiling

Option 3: PLI Top up Incentive – Under this option, eligible industrial undertakings can avail top-up on incentives received under Production Linked Incentives (PLI) Schemes of Government of India as per Section 12.3.3 of the Policy a. Top up incentive of 30% of the PLI incentives (as and when disbursed by GOI) sanctioned under any PLI Scheme of Government of India Scheme to be disbursed as and when PLI incentives are disbursed by the GoI, b. This subsidy will be subject to an overall ceiling of the incentives to be provided by GoUP will be capped at 100% of ECI. c. The List of such PLI Schemes is provided in Annexure-5, which can be updated from time to time by the Empowered Committee on the recommendation of Evaluation Committee for IIEPP 2022